Apply for a business account with an overdraft

Starting at £0 monthly. Business bank accounts that are easy to use and fully regulated.

Accounts made for self starters

Business overdrafts available on application for limited companies. T&Cs and eligibility criteria apply.

Business Go: £0/month

Apply in minutes and bank in-app or online once approved

Pay in cash at any of the UK’s 11,500 Post Offices

Sending money: 3 free payments & transfers a month (35p after)

Business Extra: £9/month

Up to 0.5% cashback on card spend. Limits apply, see 'Show all fees' for details

Sending money: 20 free payments & transfers a month

In-app messaging support

Business Pro: £19/month

Up to 1% cashback on card spend. Limits apply, see 'Show all fees' for details

Sending money: 500 free payments & transfers a month

0.75% interest earning savings pot (Limits apply. See 'Show all fees' for details)

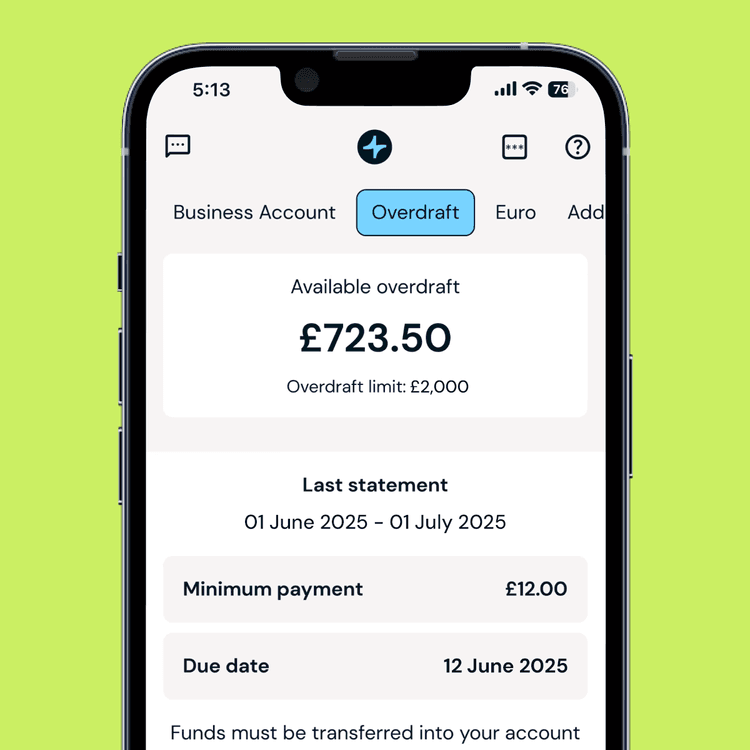

Overdraft with instant decision

You can apply for a business overdraft when you open a business bank account, or, if you're already a business bank account holder, you can check to see if you've been invited to apply via the Bank App or Online Banking.

Your overdraft is designed to work exactly when you need it - bridging gaps between invoices, covering unexpected expenses, or helping you seize time-sensitive opportunities.

Please note, sole traders are currently unable to apply for a business overdraft at the same time as they open an account.

However, if your account has been open for at least three months, we'll contact you via SMS, or a message in Online Banking/Bank app when you become eligible to apply for one. Eligibility criteria apply.

How much does an overdraft cost?

The cost of your overdraft will depend on the interest rate you pay.

When you apply, we'll show you the interest rate we can offer. Once approved, you’ll find your interest rate on your statements and in the overdraft section of your Zempler Bank app.

The first £5 of your overdraft is interest free. If you go over that £5, we'll charge interest at the end of each day you're using it.

Try our overdraft calculator

See how much an overdraft would cost, barring any annual fees. Use it to compare the cost of an overdraft with other ways of borrowing to see which is best for your business.

Summary of charges

Borrowing £250 for 28 days at 70% interest* will cost you

£0.00

in interest

*% - daily interest rate

Representative APR 0.0% (variable)

Easy to apply

If you’re looking to apply for an overdraft for your business, this will depend on how your company is structured.

- Limited company – If you’re a limited company and looking to open one of our business accounts, you can also apply for a business overdraft as part of that application. Otherwise, if your account has been open for at least three months, we’ll contact you when you become eligible.

- Sole trader – If you’re a sole trader and your account has been open for at least three months, we’ll contact you via email, SMS or a message in Online Banking/Bank app when you become eligible.

Before you apply, you can work out how much it will cost using our overdraft calculator.

How do Zempler Bank business overdrafts work?

- There's an annual fee. Our overdrafts come with an annual fee starting from £50. You'll need to pay this alongside any interest due from using your overdraft. When you pay, it will show in your bank account transaction history and bank statement.

- The first £5 of your overdraft is interest free. We’ll only charge interest on any daily overdraft balance over £5. You'll find information about your interest rate in your overdraft statements in-app and in Online Banking.

- Make at least the minimum repayment on time. Paying late can harm your business’s credit rating. The best and cheapest way to clear your balance is to pay it off in full as soon as possible.

- Stay within your limit. You can only use your Zempler Business account to pay for things that don’t take you past your overdraft limit. If you try to withdraw cash or pay for anything that takes you over your limit, it will be declined. If interest and fees take you over your limit, we won’t charge over limit fees.

- Overdraft alerts. We'll send you overdraft alerts when you’re about to enter your overdraft, have entered it, or are reaching your limit. Alerts help you manage repayments and avoid charges.

- Changing your limit. You can request the reduction or removal of your overdraft at any time by contacting us. We’ll review your overdraft limit every six months.

- Grace period – We won’t charge any interest if you dip into your overdraft and bring your account back into credit on the same day.

Security you can bank on

We're fully regulated

We’re a fully regulated British bank so your money is protected by the Financial Services Compensation Scheme (FSCS) up to £120,000 on eligible deposits.

Instant card freeze and unfreeze

If something doesn’t look right or you lose your card, freeze it instantly online or in-app. Found your card? Unfreeze it just as easily.

24/7 fraud protection

Fraudsters don’t work 9 to 5, and neither do we. From the moment you open your account, we’ll apply the latest security tech to keep it safe.

Your business overdraft questions answered

To be eligible for a Zempler Bank business overdraft you need to have had a Zempler business current account open for at least three months. We’ll let you know once you’re eligible by email, text message or in Online Banking.

You can use our eligibility checker to see if you’re likely to be approved for a business overdraft. Using the eligibility checker won’t impact your credit rating or score but doesn’t guarantee you’ll be approved for an overdraft.

You can apply for a business overdraft during your application (for limited companies) or after you’ve received an offer via email, SMS, Online Banking message or in the app, depending on what business structure you have.

- Limited company – If you’re a limited company and looking to open one of our business accounts, you can also apply for a business overdraft as part of that application. Otherwise, if your account has been open for at least three months, we’ll contact you when you become eligible.

- Sole trader – If you’re a sole trader and your account has been open for at least three months, we’ll contact you when you become eligible.

To apply as an existing customer, log in to the Zempler Bank app or Online Banking, go to ‘Add-ons’ in your Account Overview and follow the instructions.

You’ll need to read and accept the overdraft agreement and terms and conditions.

Before you apply, you can work out how much it will cost using our overdraft calculator.If your application is successful, your overdraft will typically be added to your account within a few hours. If your application comes after 4pm on a Friday or over the weekend/bank holiday, it will be available by midday on the next working day.

The first £5 of your business overdraft is interest free. We’ll charge you interest on any daily overdraft balance greater than £5.

If you’ve opened a Zempler business current account since January 2023, you will have to pay an annual fee for your overdraft on top of any interest payments.

You can find information about your interest rate and any fees in your monthly statements.

You can also use our cost calculator to see how much a business overdraft could cost, which will help you compare the cost to other ways of borrowing.

Yes, using a Zempler Bank credit add-on like a business overdraft could impact your business credit score.

If you manage your overdraft responsibly, don’t rely on it excessively and make all your repayments on time, it can have a positive impact on your credit score as it shows you are financially responsible.

If you’re late making your repayments or miss some completely, it may harm your credit score. This can reduce your business’s chances of getting credit or make it expensive for you to get credit in the future.

You should never take out more credit than you can pay.