Unfortunately you can't currently apply on our website.

Zempler Bank Business Credit Card

With 1% cashback rewards, the Zempler business credit card can be used for regular purchases, like paying suppliers and buying office equipment, or for covering one-off payments that you didn’t budget for.

You could be eligible if:

- You’re the director of a limited company and your company is registered in the UK with Companies House, or

- You're a sole trader

and

- You’re a UK resident, aged 18 or over

- You haven’t recently had a county court judgement (CCJ), Individual voluntary arrangement (IVA), or a company voluntary arrangement (CVA)

Once accepted, you’ll receive a Mastercard credit card that’s accepted at 26 million locations around the world.

Business Credit Card

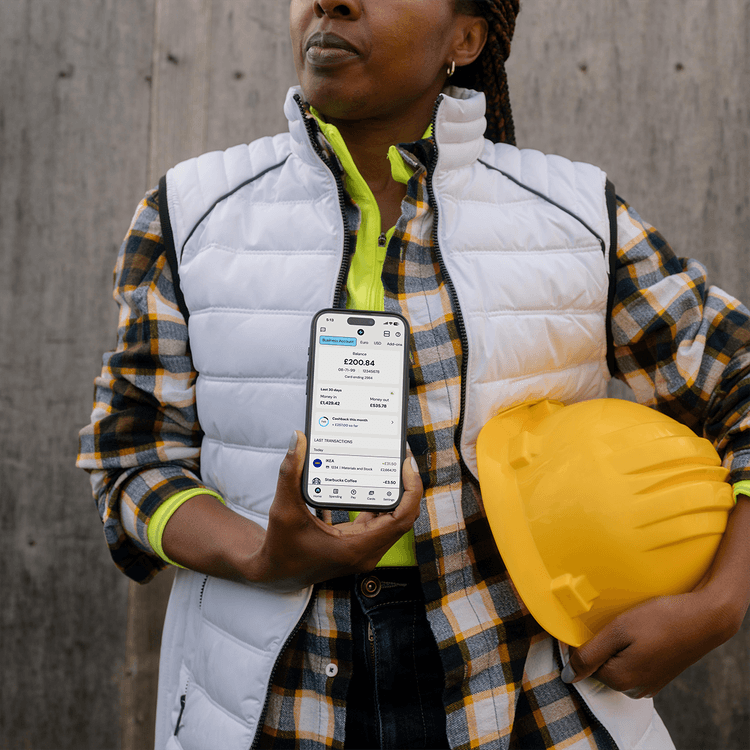

Access your account 24/7 online and in the Zempler Bank app

Track spending and see your statements on the go

Itemised billing to track business expenses more easily

Flexible repayment options

1% cashback on purchases

Interest rates as low as 19.9% p.a. variable on purchases (depending on individual circumstances).

No annual or monthly fees.

Up to 56 days’ interest-free credit, when you pay in full each month

Credit limit review within the first six months

Made from 80% recycled plastic

Security you can bank on

We’re fully regulated

We’re a fully regulated British bank.

24/7 fraud protection

Fraudsters don’t work 9 to 5, and neither do we. From the moment you open your account, we’ll apply the latest security tech to keep it safe.

Instant card freeze

If something doesn’t look right or you lose your card, freeze it instantly online or in-app. Find your card? Unfreeze it just as easily.

Credit Card cost calculator

Get an idea of how much interest you might pay with a Cashplus Credit Card.

Summary of charges

Borrowing £5000 for 56 days at 20% interest* will cost you

£0.00

in interest

*% - daily interest rate

Representative APR 0.0% (variable)

The calculation is based on the whole balance (amount due) across the average number of days selected. It assumes that you have a single transaction or balance from a specific point in time and no further transactions will be made until you make a payment.

Please be aware that any of the following could impact how much you owe in the end:

Frequently Asked Questions

Please visit our Frequently Asked Questions webpage for more information on the Zempler business credit card, our fees and charges, how to make payments, and for any other questions.

Responsible Lending

At Zempler we’re strong believers in responsible lending, and we design our products in accordance with this belief.

To find out more about what this means to you, please visit our Responsible Lending web page.

^Eligible customers with a Zempler business credit card (no annual fee) with 1% cashback receive 1% cashback on the first £100,000 of eligible card purchases each month. Cashback cannot be earned on cash advances, transactions that can be converted to cash (merchandise and services provided by financial institutions that are representative of actual cash. For example, travellers cheques, foreign currency or gambling and lottery tickets). These transactions are known as quasi-cash transactions. Government payments (including HMRC), ATM withdrawals, balance transfers, interest, fees and charges, non-member payment service provider payments, and non-card payments.