Apply for a business account in minutes

Starting at £0 monthly. Business bank accounts that are easy to use and fully regulated

Business accounts made for self starters

Business Go

£0 monthly

Simple and secure banking that gets the job done.

Card issue fee of £9.95

Sending money: 3 free payments & transfers a month (35p after)

Pay in cash at any of the UK’s 11,500 Post Offices

Send and receive international payments

FSCS protection up to £85,000 on eligible deposits

Overdraft with instant decision (eligibility criteria apply)

Business Extra

£9 monthly

Smart banking built for payments.

0.5% cashback on card spend. That’s up to £1,000 a month

Sending money: 20 free payments & transfers a month

In-app messaging support

Free cash withdrawals in the UK and abroad

Opt-in to Business Creditbuilder

Overdraft with instant decision (eligibility criteria apply)

Business Pro

£19/month

The best of everything to help your business boom.

1% cashback on card spend. That’s up to £1,000 a month

Sending money: 500 free payments and transfers a month

1% interest earning savings pot (Limits apply. See 'Show all fees' for details)

Dedicated Pro support team and in-app messaging

Fee-free card spend abroad

Overdraft with instant decision (eligibility criteria apply)

Please note that our instant decision business overdraft isn't currently available for sole traders but will be soon.

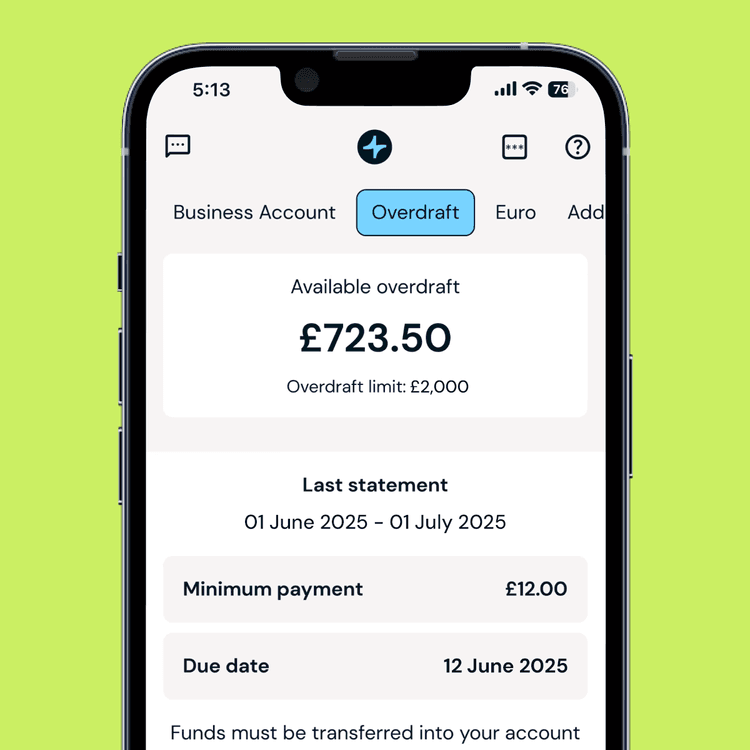

Overdraft with instant decision

You can apply for a business overdraft when you open a business account, or if you're already a business account holder you can check to see if you've been invited to apply via the Bank App or Online Banking.

Your overdraft works exactly when you need it - bridging gaps between invoices, covering unexpected expenses, or helping you seize time-sensitive opportunities.

Eligibility criteria apply. Please note that our instant decision business overdraft isn't currently available for sole traders but will be soon.

Heading small

Secondary heading small, lorem ipsum lorem ipsum lorem ipsum

Body large, lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum

![A man standing on a bus, whilst on his mobile phone]()

- Numbered list - lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum

- Numbered list - lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum

- Numbered list - lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum

- Numbered list - lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum lorem ipsum